The Single Strategy To Use For Dubai Company Expert Services

Wiki Article

Not known Details About Dubai Company Expert Services

Table of ContentsExcitement About Dubai Company Expert ServicesFacts About Dubai Company Expert Services RevealedThe Dubai Company Expert Services IdeasThe Best Guide To Dubai Company Expert ServicesRumored Buzz on Dubai Company Expert Services

As the little child claimed when he left his initial roller-coaster ride, "I such as the ups however not the downs!" Here are some of the dangers you run if you wish to begin a small company: Financial threat. The economic resources needed to begin and expand a company can be substantial.Individuals usually start services so that they'll have even more time to spend with their family members. Running a service is extremely time-consuming.

6 "The Entrepreneur's Workweek" (Dubai Company Expert Services). Vacations will certainly be hard to take and will certainly commonly be disturbed. Recently, the trouble of avoiding the work has actually been worsened by mobile phone, i, Phones, Internet-connected laptops as well as i, Pads, and lots of small company owners have actually involved regret that they're constantly obtainable.

Some people recognize from a very early age they were implied to have their very own company. There are a number of advantages to starting a service, however there are also runs the risk of that ought to be examined.

7 Simple Techniques For Dubai Company Expert Services

For others, it might be overcoming the unknown and also striking out on their very own. You specify personal fulfillment, beginning a new business could hold that guarantee for you. Whether you check out beginning an organization as a financial need or a way to make some additional income, you may find it produces a new source of revenue.Have you reviewed the competition and thought about how your particular service will prosper? One more huge decision a little company owner encounters is whether to own the business personally (sole proprietorship) or to form a different, statutory business entity.

An advantage corporation is for those entrepreneur that wish to earn a profit, while likewise offering a charitable or socially useful goal. You can form your organization entity in any kind of state Owners typically choose: the state where the organization is located, or a state with a recommended governing statute.

The entity can be a different taxed entity, indicating it will pay earnings tax obligations on its very own tax return. The entity can be a pass-through entity, suggesting the entity does not pay the tax obligations but its earnings passes through to its owner(s).

About Dubai Company Expert Services

Sole investors and partners in a partnership pay approximately 20% to 45% earnings tax obligation while firms pay corporation tax, generally at 19%. As long as corporation tax prices are reduced than earnings tax obligation prices the benefit will usually be with a restricted firm. As wage payments to employees, a firm can additionally pay returns to its investors.Supplied a minimal degree of wage is taken, the director maintains privilege to specific State benefits without any employee or company National Insurance coverage Contributions being special info payable. The equilibrium of pay is often taken as rewards, which may endure less tax obligation than income as well as which are not themselves based on National Insurance coverage Contributions.

This may be advantageous when the withdrawal of more income this year would take you right into a greater tax obligation bracket. You should constantly take professional tax obligation or financial suggestions in the light of your certain conditions, and this location is no exemption. No guidance is provided below.

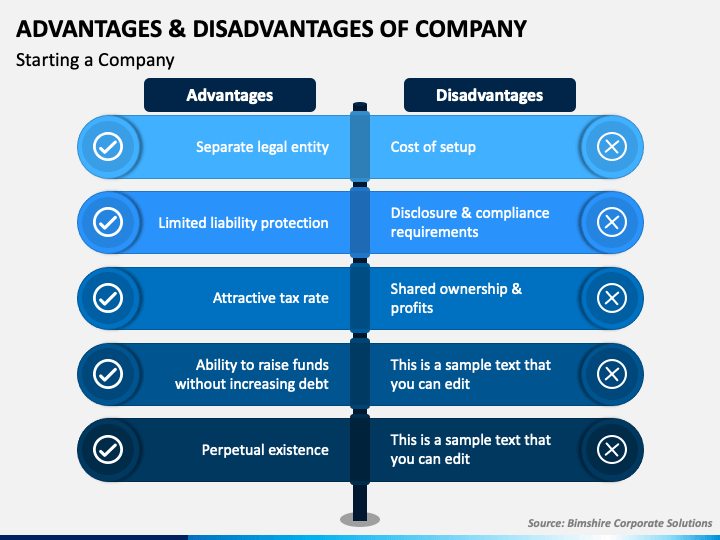

The most usual kinds of firms are C-corps (dual taxed) as well as S-corps (not double taxed). Benefits of a corporation include personal liability security, business safety and security as well as connection, and also simpler accessibility to funding. Downsides of a company include it being time-consuming and also based on double tax, as well as having rigid formalities and methods to comply with.

The Ultimate Guide To Dubai Company Expert Services

One alternative is to structure as a corporation. There are a number of reasons why including can be beneficial to your business, there are a couple of disadvantages to be mindful of. To help you determine if a firm is the best lawful framework for your service, we consulted with lawful specialists to break down the various kinds of firms, and the advantages and disadvantages of incorporating.For lots of businesses, these demands consist of creating business laws and declaring articles of consolidation with the assistant of state. Preparing all the information to file your posts of unification can take weeks or even months, however as quickly as you've effectively submitted them with your assistant of state, your company is officially identified as a corporation.

Firms are generally regulated by a board of directors elected by the shareholders."Each owner of the corporation typically owns a portion of the business based on the number of shares they hold.

A corporation offers a lot more individual property responsibility defense to its proprietors than any type of other entity type. For example, if a corporation is taken legal action against, the shareholders are not personally responsible for company financial debts or lawful commitments also if the company doesn't have enough cash in properties for payment. Personal liability defense is just one of the primary reasons businesses pick to include.

Dubai Company Expert Services Fundamentals Explained

This access to financing is a luxury that entity kinds don't have. It is wonderful not only for expanding a company, yet also for saving a firm from declaring bankruptcy in times of requirement. Although some corporations (C companies) undergo double tax, various other firm structures (S companies) have tax obligation benefits, relying on how their revenue is distributed.Any income assigned as owner income will certainly undergo self-employment tax obligation, whereas the rest of business dividends will be taxed at its own level (no self-employment tax). A corporation is not for everyone, and it could wind up costing you more money and time than it deserves. Prior to coming to be a firm, you need to be aware of these possible negative aspects: There is an extensive application procedure, you have to adhere to read inflexible procedures and also procedures, it can be costly, as well as you may be double exhausted (depending on your corporation framework).

You need to comply with lots of formalities as well as heavy policies to maintain your company status. For example, you require to follow your laws, preserve a board of directors, hold yearly conferences, keep board mins and also produce annual records. There are likewise restrictions on specific corporation kinds (for instance, S-corps can only have up to 100 investors, who must all be united state. There are a number of types of firms, including C firms, S companies, B corporations, shut corporations and also nonprofit firms. Each has it benefits and also downsides. Some alternatives to firms are sole proprietorships, collaborations, LLCs and cooperatives. basics As one of one of the most common kinds of corporations, a C company (C-corp) can have a limitless number of shareholders as well as is tired on its earnings as a different entity.

Report this wiki page